RedeConnect® is our virtual networking event open exclusively to Rede client GPs and our diverse network of LPs

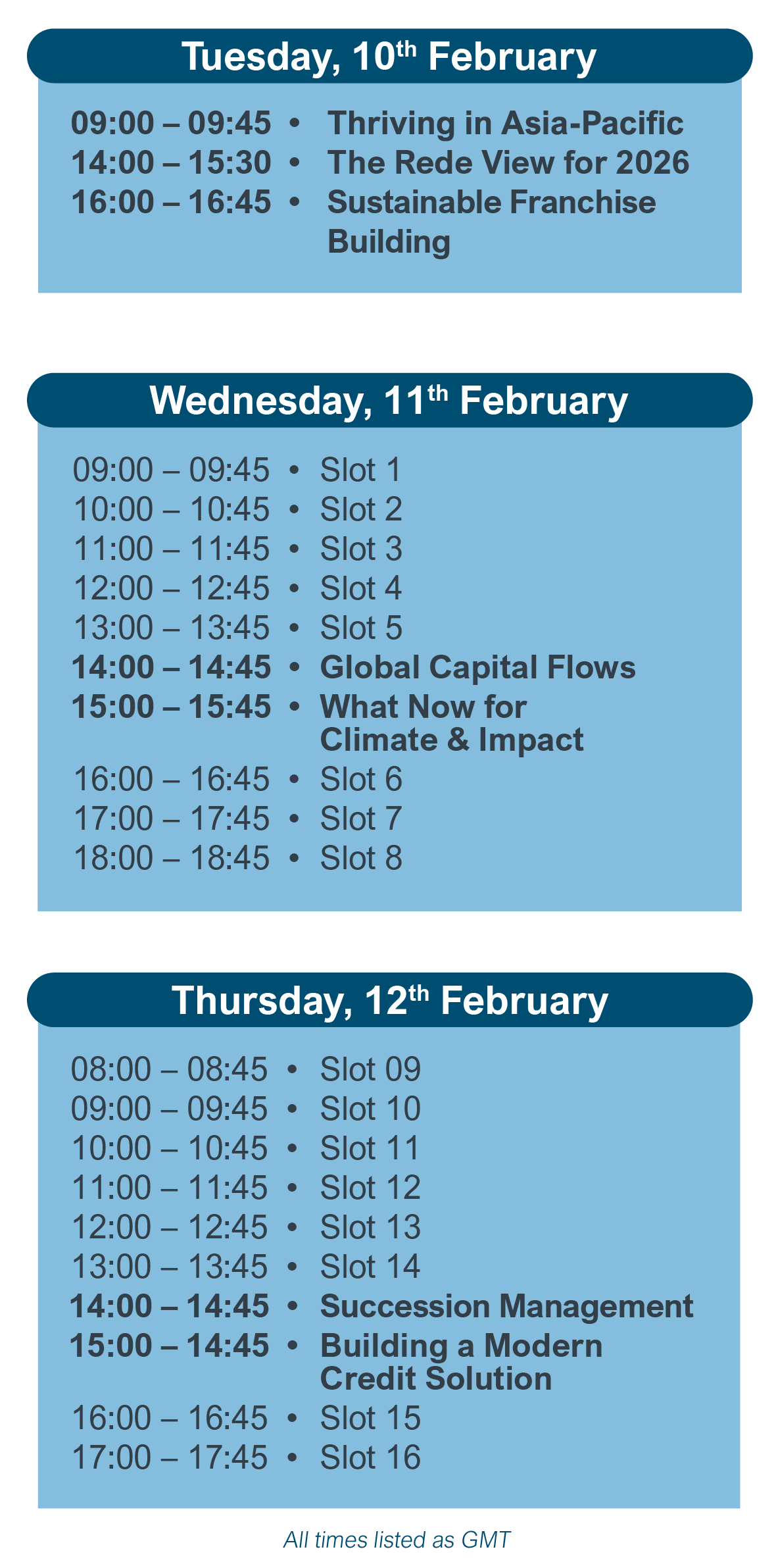

RedeConnect® will feature seven informative webinars and 16 slots for LPs to attend small, curated group GP presentations at invitation-only Roundtable meetings. RedeConnect® has been designed as an efficient way for GPs to keep LPs up-to-date with their story and inform the market on recent developments.

Your experience at RedeConnect® 2026

Each Roundtable is an invitation only, 45-minute virtual meeting between a presenting GP and up to 12 qualified LPs. Multiple Roundtables will take place simultaneously.

Each Roundtable session will start with a 30 minute presentation by the GP, leaving 15 minutes for questions. The timetable includes meeting slots to suit LPs in a variety of time zones.

RedeConnect® is hosted entirely on Zoom, in order to ensure flexibility, user familiarity and high technical standards. A Rede host will be present at each Roundtable to chair the session and resolve any technical issues.

You will receive a detailed agenda in advance of the event and presentation materials will be shared with you afterwards.

LP registration process

You can confirm your attendance at RedeConnect using the button below.

You will be able to RSVP to join our open-invitation webinars. You can also select GPs with whom you would be interested to join a Roundtable session, and will be asked to indicate which meeting slots suit your timetable.

We will send you an automated calendar hold for all slots you have indicated as available, and we request that you keep these free while we schedule your meetings. Once we have completed the scheduling process, we will be in touch as soon as possible to allow you to free up any unused slots. We will be mindful of your time when compiling the final schedule, to ensure that your agenda is as efficient as possible.

If you have multiple team members attending RedeConnect, we will be happy to work with you to optimise the agenda of your team as a whole, ensuring you meet with as many of your target GPs as possible.

Rountable and webinar schedule

RedeConnect® 2026 GP participants

Emerging managers

▶

Emerging managers ▶

Specialist lower mid-market investor with a replicable approach to transforming underperforming industrials businesses in North America

UK lower mid-market buyout investor focused on asset-light roll-ups, roll-outs and transformative mergers in business services, financial and technology services, healthcare, and education

Emerging buyout specialist transforming European industrials and business services companies leveraging a 15-shared year investment track record, decades of hands-on experience and privileged C-suite relationships

Specialized alternative Credit manager focused on Europe’s underserved market targeting pools of diversified, granular and cash flowing assets, offering attractive risk-adjusted returns with robust downside protection

Pan-European specialty lender operating below the radar of traditional European direct lenders, targeting control senior secured investments in SME businesses with resilient business models

High touch, value-oriented pan-European lower-mid market manager professionalising small businesses in attractive markets

First time fund focused on transforming operationally sound, but not strategically optimized, middle-market industrials companies, leveraging 25+ years’ experience in the sector and a high-quality, driven investment team with a shared heritage

ETNA

Emerging manager specialised in building the resilience Europe urgently needs across defence, cybersecurity and the protection of critical infrastructure through a mid-market buyout approach

High-conviction provider of bespoke capital solutions to the underpenetrated European mid-market, founded by Jacob Ucar, a former senior executive at Park Square with 16 years of specialist credit experience

Specialist investor targeting high-growth Digital Services businesses benefitting from powerful and disruptive structural tailwinds in tech innovation

Emerging advanced industrials manager in the DACH LMM, founded by three partners with sophisticated operational capabilities, rich industrial heritage, and strong track records

New firm powering the businesses creating shared moments beyond our homes and workplaces

Established managers

▶

Established managers ▶

One of the most established corporate special situations debt managers in the European mid-market, delivering compelling risk adjusted high-teens net IRRs since 2006

Leading lower mid-market buy-and-build specialist in the Benelux and Germany, partnering with ambitious founders to transform high-performing businesses into international strategic assets

High-performing UK lower mid-market manager investing in primary growth buyouts at disciplined valuations, via advantageous / complex deal situations

Software & services specialist focused on control positions in profitable businesses enabling the energy transition

Top-performing middle market investor leveraging its unique platform and network to invest in dominant niche leaders within specialist sub-sectors

Lower mid-market software and data specialist driving 'second-stage growth' to create mid-market leaders in the highest growth segment of the UK economy

Proven strategy designed to build a portfolio of the best European mid-market companies through a focus on single-asset GP-led continuation vehicles

European lower mid-market specialist transforming B2B businesses with strong fundamentals and solvable complexity to deliver exceptional asymmetric returns

The reference GP in Europe’s fastest growing large economy: Poland+ Mid-Market Buyout Specialist

Asset-backed lending to the seniors housing and care sector, targeting mid-teens unlevered returns with strong cash yield and zero principal losses since inception

Two decades investing in the Norwegian lower mid-market, identifying emerging structural growth trends via thematic work and targeting strategic assets on path to category leadership

Leading Iberian investment firm, accessing ‘hidden gems’ in niche industries through a LMM buyout strategy

Leading LMM buy and build investor specialising in transforming niche French businesses into strategic international platforms

Pioneer investor in Northern Europe with a >35-year track record of investing in control growth buyouts and driving transformative growth through deep subsector knowledge

Flagship

Pioneer investor in subsector-focused growth-oriented buyouts in Northern Europe's most attractive investment niches. NC Elevate provides concentrated exposure to decarbonisation, circularity and future of health investments

Elevate

Leading Northern European buyout investor with a proven ability to deliver superior returns by scaling companies that provide solutions to structural global challenges

Conviction-led investor with a 23-year track record of delivering superior returns in the European mid-market through a hands-on transformational approach and strong downside protection

Growth-oriented active owner investing in small and mid-size companies primarily in Sweden and the rest of the Nordic region with distinct growth and development potential

Sustainable Real Assets investor focused on changing unit economics in agriculture, energy, and transportation underpinned by its highly tuned and asset-backed investment approach

Specialist investor in B2B tech and tech-enabled businesses, accelerating growth of profitable, mid-market firms in Northern Europe

Lower mid-market buyout investor focused on niche, specialised sectors where Italian companies lead on a global basis

The Rede View for 2026

The outlook for the next 12 months in private equity.

Rede's annual keynote webinar, presented by Rede Partners senior leaders

RedeConnect® 2026 webinar series

Thriving in Asia-Pacific

Building a winning strategy in a complex landscape.

Panel discussion featuring leading Asia-Pacific GPs, moderated by Charles Wan, Rede's Head of Asia

Sustainable Franchise Building

How market-leading GPs are unlocking their platforms' full potential.

Panel discussion featuring thought-leading market participants, moderated by Nikki Ruklic, Rede's Head of Strategic Advisory Services

Global Capital Flows

Where are the new pockets of LP capital to be found and accessed?

Panel discussion featuring Rede's global LP Coverage Heads, moderated by Rede Senior Partner, Scott Church

Where Now for Climate & Impact?

How market-leading LPs are evolving their programmes.

Panel discussion featuring leading Climate & Impact LPs, moderated by Etiene Ekpo-Utip, Rede's Head of Climate & Impact

Succession Management

A view from the front line.

Fireside chat with Emily Taylor, Managing Director and Co-Head of Private Capital at Russell Reynolds, moderated by Magnus Goodlad, Rede's Co-Head of Capital Solutions

Building a Modern Credit Manager

What it takes to build a next-generation Credit platform.

Panel discussion featuring successful emerging Credit GPs, moderated by Charles Savinar, Rede Principal and Credit Specialist